Engines of enhanced customer experience

We have the technology to provide one-to-one intimacy in marketing with engines of enhanced, in context, real-time and predictive customer experiences.

Neuroscience, behavioral economics and psychology combine to make the automated promise of AI one which delivers the truly effective next best offer or action.

The world of one-to-one CRM is here, with the capability to predict your needs and respond to them as they arise. We can apply Robotic Process Automation to deliver this efficiently and at scale.

The world of one-to-one CRM is here, with the capability to predict your needs and respond to them as they arise. We can apply Robotic Process Automation to deliver this efficiently and at scale.

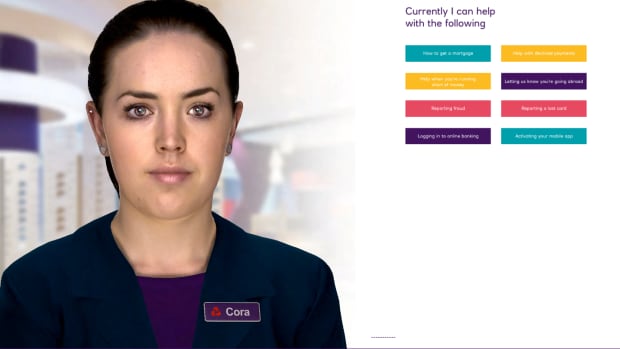

And yet - when NatWest brings us Cora - an AI-driven, human-faced service bot, it creates an experience which could cut down the time required by a teller to serve you. But the upside for the customer is strangely limited. Despite our being able to speak with this voice-recognising screen-based bot, it responds by telling us to log in and complete a form.

It's an early test. I suspect it won't get deployed unless and until the team apply a little human-centred thought. If it recognises voice it could recognise YOUR voice - removing the need for log-in. If it recognises what you are asking, it could understand what of the records it has on you that it needs to access to complete the form for 'I've lost my credit card' or similar.

The same thinking can be applied to the very long queue in my local branch of LLoyds on Saturday morning.

Today's queue at the bank is made up of people who either do not or will not use internet services, and those who need some kind of physical exchange. The other folk in looking for mortgages etc have nice places to sit and wait for their appointments.

There was one teller on duty. Another employee fluttered around the queue asking what we were trying to achieve today, leading some folk off to machines if they found that was relevant - trying to lever some behaviour change into them.

My need was for physical exchange - converting unspent holiday currency into GBP - so I was left in the queue.

The experience illustrated much that is wrong with automating customer experience.

At the counter, I handed over my bank account card and my currency. The teller then had to fill in a form by hand to confirm she was handing over the currency exchanged and I was accepting the rate etc. She got to the point when she asked for a contact number and I was half way through responding when I said - "hang on a minute. You've got my bank account card, surely from that you can tell my name, address, contact number, bank account numbers etc. Why are we filling all that in again now?"

No doubt the poor teller's hand-written form will be typed in to create a digital record at some point further down the line.

If a written record is essential, surely it could be auto-created - saving time for both customer and teller - and cutting that queue. And a little bit of intelligence would identify that I regularly return from a trip with excess currency. Why doesn't my bank - which knows when I am back from my spending patterns - send me an invite with a rate for exchange (which I could compare with others). I could confirm an appointment to make the swift handover with form pre-completed and ready to roll.

Processes like these are easy to set-up in self-learning AI-powered workflow tools. With some platforms the set up work doesn't even require external expertise, the users themselves simply do their job and the AI learns which bits can be automated and/or optimised.

But for all this, unless the creation of value for the end-using human is the focus, each application of our engines of enhanced customer experience will only improve our efficiency at doing the wrong thing.

Neuroscience, behavioral economics and psychology combine to make the automated promise of AI one which delivers the truly effective next best offer or action.

And yet - when NatWest brings us Cora - an AI-driven, human-faced service bot, it creates an experience which could cut down the time required by a teller to serve you. But the upside for the customer is strangely limited. Despite our being able to speak with this voice-recognising screen-based bot, it responds by telling us to log in and complete a form.

It's an early test. I suspect it won't get deployed unless and until the team apply a little human-centred thought. If it recognises voice it could recognise YOUR voice - removing the need for log-in. If it recognises what you are asking, it could understand what of the records it has on you that it needs to access to complete the form for 'I've lost my credit card' or similar.

The same thinking can be applied to the very long queue in my local branch of LLoyds on Saturday morning.

Today's queue at the bank is made up of people who either do not or will not use internet services, and those who need some kind of physical exchange. The other folk in looking for mortgages etc have nice places to sit and wait for their appointments.

There was one teller on duty. Another employee fluttered around the queue asking what we were trying to achieve today, leading some folk off to machines if they found that was relevant - trying to lever some behaviour change into them.

My need was for physical exchange - converting unspent holiday currency into GBP - so I was left in the queue.

The experience illustrated much that is wrong with automating customer experience.

At the counter, I handed over my bank account card and my currency. The teller then had to fill in a form by hand to confirm she was handing over the currency exchanged and I was accepting the rate etc. She got to the point when she asked for a contact number and I was half way through responding when I said - "hang on a minute. You've got my bank account card, surely from that you can tell my name, address, contact number, bank account numbers etc. Why are we filling all that in again now?"

No doubt the poor teller's hand-written form will be typed in to create a digital record at some point further down the line.

If a written record is essential, surely it could be auto-created - saving time for both customer and teller - and cutting that queue. And a little bit of intelligence would identify that I regularly return from a trip with excess currency. Why doesn't my bank - which knows when I am back from my spending patterns - send me an invite with a rate for exchange (which I could compare with others). I could confirm an appointment to make the swift handover with form pre-completed and ready to roll.

Processes like these are easy to set-up in self-learning AI-powered workflow tools. With some platforms the set up work doesn't even require external expertise, the users themselves simply do their job and the AI learns which bits can be automated and/or optimised.

But for all this, unless the creation of value for the end-using human is the focus, each application of our engines of enhanced customer experience will only improve our efficiency at doing the wrong thing.

DONASI VIA PAYPAL

Bantu berikan donasi jika artikelnya dirasa bermanfaat. Donasi akan digunakan untuk memperpanjang domain https://fasterfutureonline.blogspot.com/. Terima kasih.

Newer Posts

Newer Posts

Older Posts

Older Posts

KaXTam

KaXTam

Comments